Hello there!

Today, we'll be talking about something that is often overlooked when creating

a budget: sinking funds. Sinking funds are an important aspect of budgeting

that can help you reach your financial goals and provide a cushion for

unexpected expenses.

So, what exactly

are sinking funds in a budget? Simply put, a sinking fund is a pool of money

set aside for a specific purpose or expense. Unlike an emergency fund, which is

used to cover unexpected expenses, sinking funds are planned for in advance and

used for anticipated expenses. This can include things like car repairs, home

maintenance, annual subscriptions, vacations, or even a down payment on a new

home.

To give you a

better idea of how sinking funds work, let's look at a few practical examples.

Let's say you're planning a vacation for next summer. Instead of putting the

entire cost of the trip on a credit card or taking money out of your emergency

fund, you can start setting aside money each month into a sinking fund

specifically for that vacation. By the time your trip rolls around, you'll have

the funds needed to pay for it without having to worry about going into debt.

Another example

is home repairs. We all know that home maintenance and repairs can be

expensive, but they're also necessary to keep your home in good condition.

Instead of waiting until something breaks to scramble for the funds, you can

set up a sinking fund specifically for home repairs. This will allow you to

stay on top of maintenance and repairs without having to worry about the cost.

|

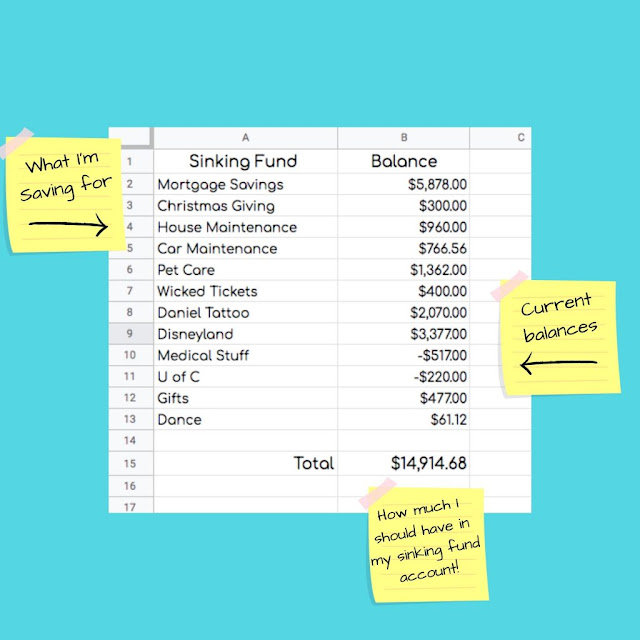

| [source/ Reach for More] |

Now that you

have a better idea of what sinking funds are and how they work, let's talk

about how to set them up. Here are a few steps to get you started:

- Identify your anticipated expenses: Start by

identifying any expenses that you anticipate in the next year or two. This

could include things like car repairs, home maintenance, medical expenses,

or even gifts for holidays or birthdays.

- Estimate the cost: Once you've identified your

anticipated expenses, estimate the cost of each item. This will give you

an idea of how much you need to set aside each month.

- Create a separate account: To keep your sinking

funds organized, consider creating a separate account for each one. This

will allow you to track your progress and ensure that the funds are being

used for their intended purpose.

- Set up automatic contributions: To make sure you're

consistently contributing to your sinking funds, consider setting up

automatic contributions each month. This will help ensure that you're

saving enough to cover your anticipated expenses.

- Adjust as needed: As your expenses change or new ones arise, be sure to adjust your sinking funds accordingly. This will help ensure that you're always prepared for whatever life throws your way.

Sinking funds

are an important aspect of budgeting that can help you reach your financial

goals and stay on top of anticipated expenses. By identifying your expenses,

estimating the cost, and setting up automatic contributions, you can ensure

that you're always prepared for whatever life throws your way. So, next time

you're creating a budget, don't forget to include sinking funds!

Also Read: Tips to help you save money when you have a tight budget

Post a Comment