|

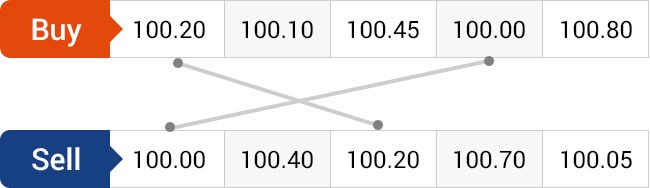

| Process of Matching Orders when buying or selling shares. (Source / Edelweiss) |

- Matching

orders refers to the process of entering buy and sell orders and they pair

to facilitate the trading of the security.

- In exchange

markets today, buy and sell orders are matched electronically.

- Many

algorithms are available for matching buy and sell orders. However, the

First-In-First-Out (FIFO) and Pro-Rata algorithms are the most widely used

matching order algorithms.

Many retail investors buy shares of companies

on the secondary stock market. This market uses the willing-buyer-willing-seller

basis to trade in securities.

Therefore a transaction is completed when an

investor wants to buy a specific amount of a security and another investor

wants to sell a comparable amount of that asset at a comparable price. In this

case, both investors' orders match. In order to execute the trading of

securities, buy orders are matched with sell orders using a matching orders

mechanism.

Order matching used to be done offline by

brokers. Open auctions used to match orders through face-to-face exchanges, but

today orders are handled online.

When purchase and sell orders placed for the

same stock or security are reasonably timed and priced, matching takes place.

If the maximum price of the buy order is

greater than or equal to the minimum price of the sell order, the buy and sell

orders are considered to be compatible. The matching computerized algorithms

then prioritize the compatible buy and sell orders.

The matching order system works effectively to maximize the number of orders while providing benefits to both buyers and sellers equally.

There are numerous algorithms available for matching orders, but picking the right one for the trading system is essential. Pro-Rata and First-In-First-Out (FIFO) are the two most popular algorithms for matching orders. As an investor you have to know how this works. Well, here is how it works.

1. First-in-First-Out (FIFO)

FIFO is also known as a price-time algorithm.

According to the FIFO algorithm, buy orders take priority in the order of price

and time. Then, buy orders with the same maximum price are prioritized based on

the time of bid, and priority is given to the first buy order. It is

automatically prioritized over the buy orders at lower prices.

For example, a buy order for 200 shares of a

security at $5 per share is followed by another buy order of 100 shares of the

same security at a similar price.

According to the FIFO algorithm, the total 200

shares buy order will be matched to sell orders. There can be more than one

sell order. After the 200 shares buy order is matched, the 100 shares buy order

matching will start.

2. Pro-Rata

A system using the Pro-Rata algorithm also

gives priority to the highest-priced buy order. However, buy orders with the

same highest price are matched in proportion to each order size.

For example, buy orders of 200 shares and 100

shares of the same security are active in the system. At the same time, a

compatible sell order of 200 shares becomes active. The sell order will not be

able to fulfill both the buy orders.

The Pro-Rata algorithm will match 125 shares to

the 200-share buy order and 75 shares to the 100-share buy order. Hence, both

buy orders are partially filled. Here, the Pro-Rata algorithm fills 75 percent

of both buy orders.

Post a Comment